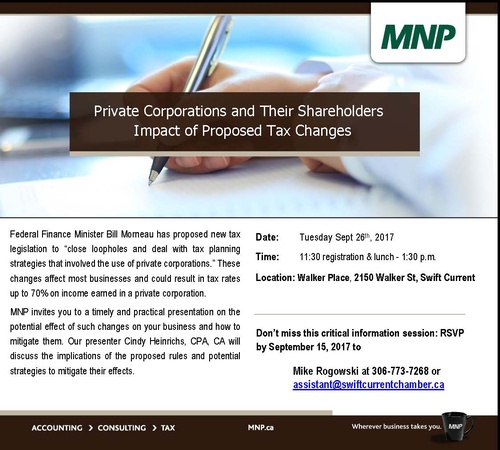

Private Corporations and Their Shareholders Impact of Proposed Tax Changes

Federal Finance Minister Bill Morneau has proposed new tax legislation to "close loopholes and deal with tax planning strategies that involved the use of private corporations." These changes affect most businesses and could result in tax rates up to 70% on income earned in a private corporation.

MNP invites you to a timely and practical presentation on the potential effect of such changes on your business and how to mitigate them. Our presenter Cindy Heinrichs, CPA, CA will discuss the implications of the proposed rules and potential strategies to mitigate their effects.

Date and Time

Tuesday Sep 26, 2017

11:30 AM - 1:30 PM CST

Tuesday September 26th, 2017

11:30 - 1:30 p.m.

Fees/Admission

Free to attend

Contact Information

Mike Rogowski

Send Email